homeownership

qualify and apply

The Habitat for Humanity Homeownership Program provides a unique opportunity for hardworking families to “build and buy” their own homes. Houses are sold to new homeowners with an affordable mortgage. Home payments vary.

Our affiliate builds homes in Salem, Keizer, Stayton, Lyons, Aumsville, Mill City, Mehama, Sublimity, Turner, Dallas, Independence, and Monmouth. If you are interested in purchasing a Habitat home elsewhere, contact the Habitat affiliate in your area.

Applications for the 2024 Homeownership Program are now closed.

For any questions, please contact Kattrina Osborn at 503-342-1268 or [email protected].

basic qualifications

- Must be a United States citizen or permanent legal resident

- Must live in our affiliate service area for at least 12 months (click here to verify your zip code is in our service area)

- Cannot have owned a home during the past 3 years

- Cannot have a bankruptcy discharged within the past 3 years

- Currently living in sub-standard, subsidized, overcrowded or unaffordable housing

- Must be willing to contribute 500 volunteer hours – “sweat equity” (250 hours for households with 1 adult)

- Must have proof of steady income sufficient to repay an affordable mortgage and satisfactory credit history

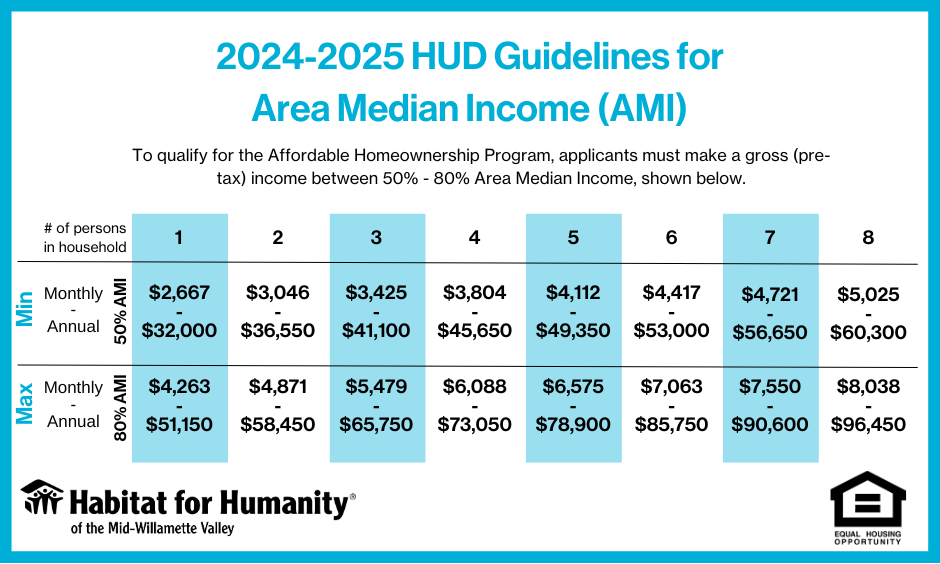

- Must be within 50% to 80% of the Marion County median household income

Income requirements are subject to annual revision. Current income values are valid until April, 2025.

how to apply

Applications are currently closed. To sign up for our information list and be notified of future application dates, click below.

information sessions

Application Information sessions are held prior to each round of selection for the Homeownership Program. Check our Facebook page for updated meeting times and places. At the Application Information Meeting we will distribute Homeownership Program applications and discuss:

- Habitat 101- Who We Are & What We Do

- The Homeownership Program (benefits, qualifications, requirements, where we build, Habitat for Humanity mortgages and home payments)

- How to Complete an Application Form

- How Applicants Are Selected

- What to Expect if You Are Selected

upcoming sessions

faq’s

What are the qualifications for the Homeownership Program?

Who can be a part of my household? How is my household size determined?

How is the number of bedrooms determined?

Do I have to be a US Citizen or have permanent residency?

Will a credit check be required?

How long will it take for me to get a home?

The whole process from application to move in may take up to 18 months. There are many factors involved with getting your home: available land, sweat equity hours, specific needs, etc. We are committed to getting you in your home as quickly as possible and in return we appreciate your hard work and patience.

Once an application is completed and turned in, what happens next?

Your initial application will be reviewed and evaluated based on the information you have supplied. If your application is not rejected for any disqualifying reason, you will be asked to provide additional supporting documentation in evidence of your income, debt and certain expenses. This documentation may include paystubs, benefit statements, tax returns, copies of your birth certificate, passport or residency card, bank statements, and more.

We may conduct credit, criminal and sex offender screening at any point during the process. If your application passes this round of evaluation, we will contact you to schedule an interview which may include a home visit. This entire process may take several weeks or months. You will receive a notification at least every 30 days, if not sooner, regarding the status of your application and any actions that you must take.

After the interview and home visit, (if any) Habitat will review all information gathered throughout the process and determine who will be selected into the Habitat Homeownership Program. The entire process from turning in your initial paper application to receiving an acceptance or denial letter is considered our “application process”. A complete application must be submitted in order to be accepted.

How does a Habitat mortgage work?

Habitat’s home ownership program is unique in two ways: (1) Habitat sells houses at the cost of materials plus real estate without adding in profit; 2) Habitat sells the house charging only a minimal interest rate. The low-interest mortgage is significant because a loan from a commercial bank adds higher, market-rate interest payments, which oftentimes will double the “cost” of the home to the buyer.

Our goal is that families repay their mortgages as fast as they are able. Mortgages are for up to 30 years in order to keep payments affordable. There is no penalty to the buyer for paying off the mortgage ahead of schedule – though other restrictions may remain in place for the entire original mortgage period.

Do I get to choose where I live?

How can I earn sweat equity hours?

What are homeowner classes?

How big will my house be?

House size depends on the number of family members who will be living there. The following is the maximum square footage for each house size: 900 square feet for a two-bedroom house, 1070 square feet for a three bedroom house, 1230 square feet for a four-bedroom house. The square foot numbers describe living space not including stairwells, crawl space and exterior storage.

Do I have a choice about what goes into my home?

Does my house come with any warranties?

What if I need or want to sell my house?

What about existing debt?

Having debt does not automatically disqualify you from the homeownership program. The amount of debt, your payment history and current income will be evaluated during the application process to determine whether your debt-to-income ratio is within our limits.

In some cases, we may refer you to debt management classes to help you better qualify for housing in our program. In order to be able to complete the program and qualify for housing, your total monthly debt service, including your anticipated mortgage principal and interest, property taxes and homeowner’s insurance, may not exceed 40% of your monthly income.

If I own another home, can I still qualify for Habitat’s Homeownership Program?

What types of income are counted when I apply?

All forms of regular, stable income should be included as a part of household income and will be considered. If you are regularly seasonally employed and receive

unemployment compensation for part of the year, both your wages and the unemployment compensation will be counted as “income.” All income must be documented if we ask for it.

Documentation may include items such as paystubs, benefit statements or award letters, copies of court ordered support or alimony, etc. Temporary income, or income that will not continue past 3 years’ time is generally not considered.